PayPal’s all-in-one checkout solution with great new features. But no additional cost.

The new PayPal Checkout integration offers PayPal, card processing, Apple Pay, Google Pay™, Venmo (US only), Pay Later, and an improved checkout experience for your customers. It’s free. And easy to add.

PayPal

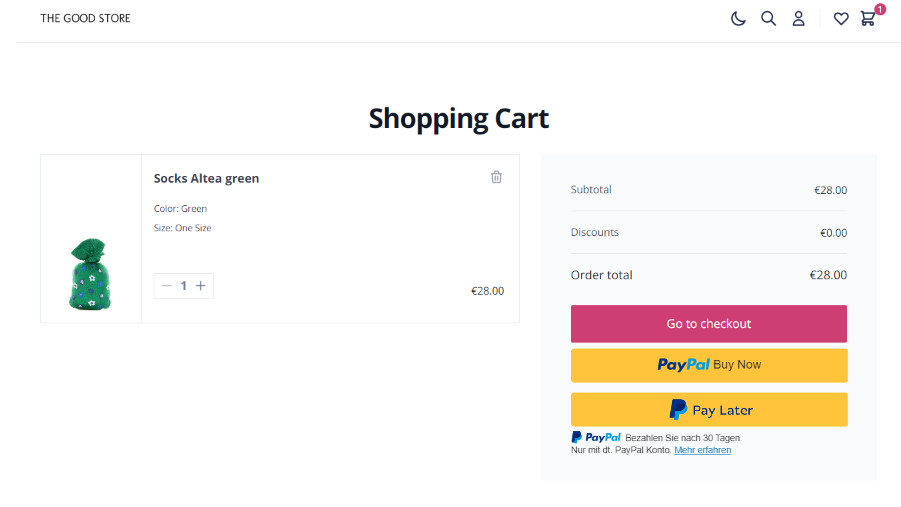

Help increase conversion by automatically offering PayPal buttons on product pages and at checkout. Consumers have a 46% higher checkout conversion with PayPal.*

Pay Later

Allow customers to pay later(1) while you get paid up front — at no extra cost to your business. Turn on Pay Later messaging to automatically present the most relevant Pay Later option as your customers browse, shop, and check out.

35% increase in cart size with Pay Later offers, when compared to standard PayPal transactions.(2) Pay Later options are available in these countries**: US, Australia, France, UK, Germany, Italy, Spain.

Venmo (US-only)

Venmo is already part of your integration — at no additional cost. Gain appeal to Venmo customers by letting customers pay for purchases the same way they pay their friends. And help bring more visibility to your business with a payment method customers can easily share.

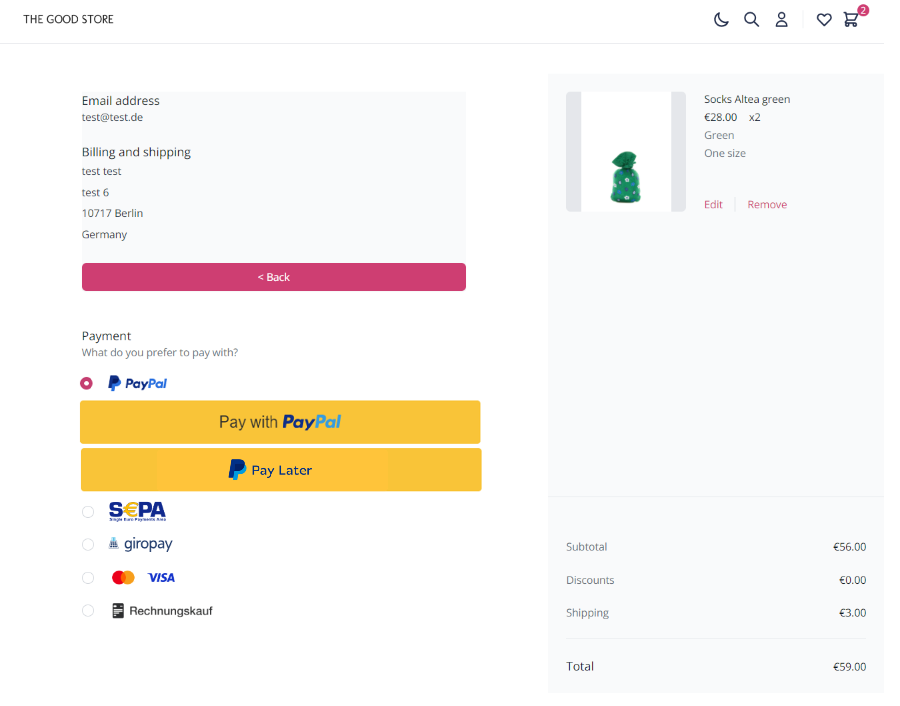

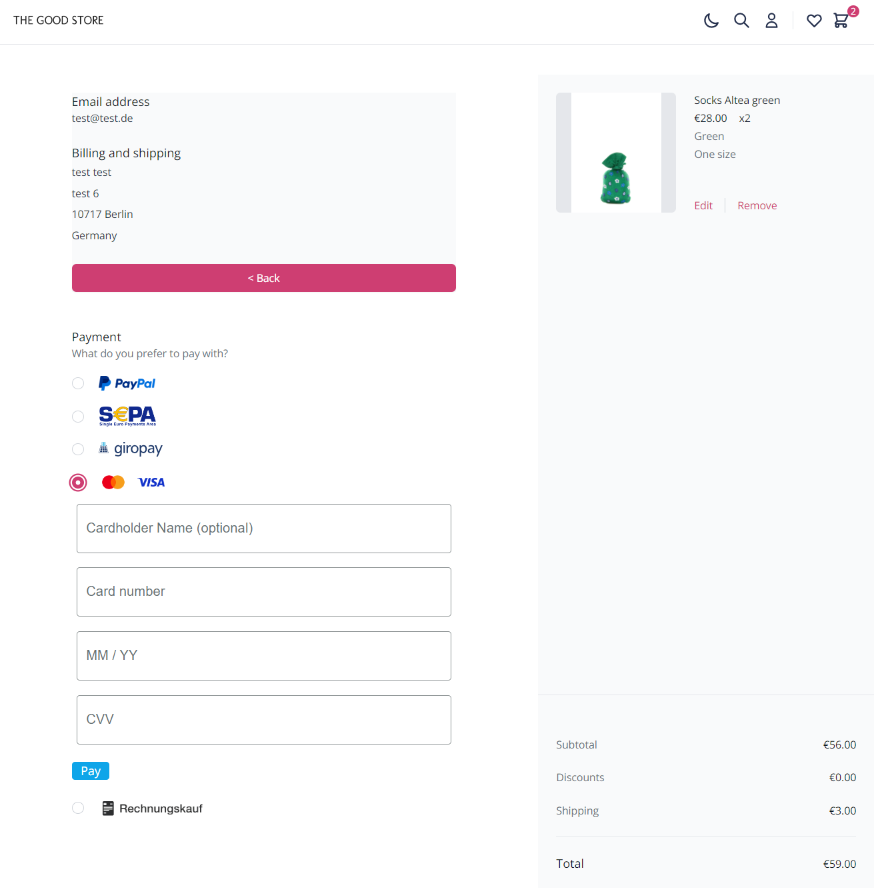

Credit and debit cards

With PayPal, you can process all major credit and debit cards at a competitive rate. By bringing payments under one roof you can simplify reporting and consolidate your settlements to better understand your business.

95% checkout completion rate for credit and debit card payments.(3)

Apple Pay and Google Pay™

Apple Pay and Google Pay™ are part of PayPal’s all-in-one solution so you won’t have to juggle multiple payment providers.

Save Payment Methods (Vaulting)

Make repeat purchasing easy. PayPal enables you to securely save your customers’ payment methods, including PayPal, Venmo (US only), Apple Pay, and credit and debit cards, providing a quick and easy checkout experience.

Package Tracking

Minimize time spent dealing with delivery inquiries and reduce the number of “items not received”. PayPal users can track their purchases to their doorsteps in real time with PayPal’s new Package Tracking, part of PayPal Checkout reimagined. Increasing users’ visibility may help businesses enhance efficiencies through integrated order management with consolidated receipts.

Country-specific payment methods

With country-specific payment methods, you can reach international customers while making your business feel local. Build trust with local payment options that correspond to the shopper’s location.

Improved checkout to help grow sales.

PayPal Checkout comes with a streamlined checkout process to help speed up customer transaction times and reduce cart abandonment — especially for those on mobile.

AI fraud detection.

PayPal’s AI software helps protect your business against fraud and evolving cyber threats to promote peace of mind for your business and customers.

More reasons to offer PayPal.

PayPal’s size, scale, and volume allows for strong relationships with card networks, issuers, and acquirers globally to help you better serve customers, minimize costs, and drive sales.

$1.36 trillion total payment volume in 2022

$20+ billion transactions annually

400+ million active PayPal accounts

35 million active merchant accounts

#1 most downloaded finance and banking app globally(4)

200+ markets

130+ currencies

#1 in Consumer Report analysis for privacy, transparency, and security(5)

Payment Methods

This connector supports the following payment methods:

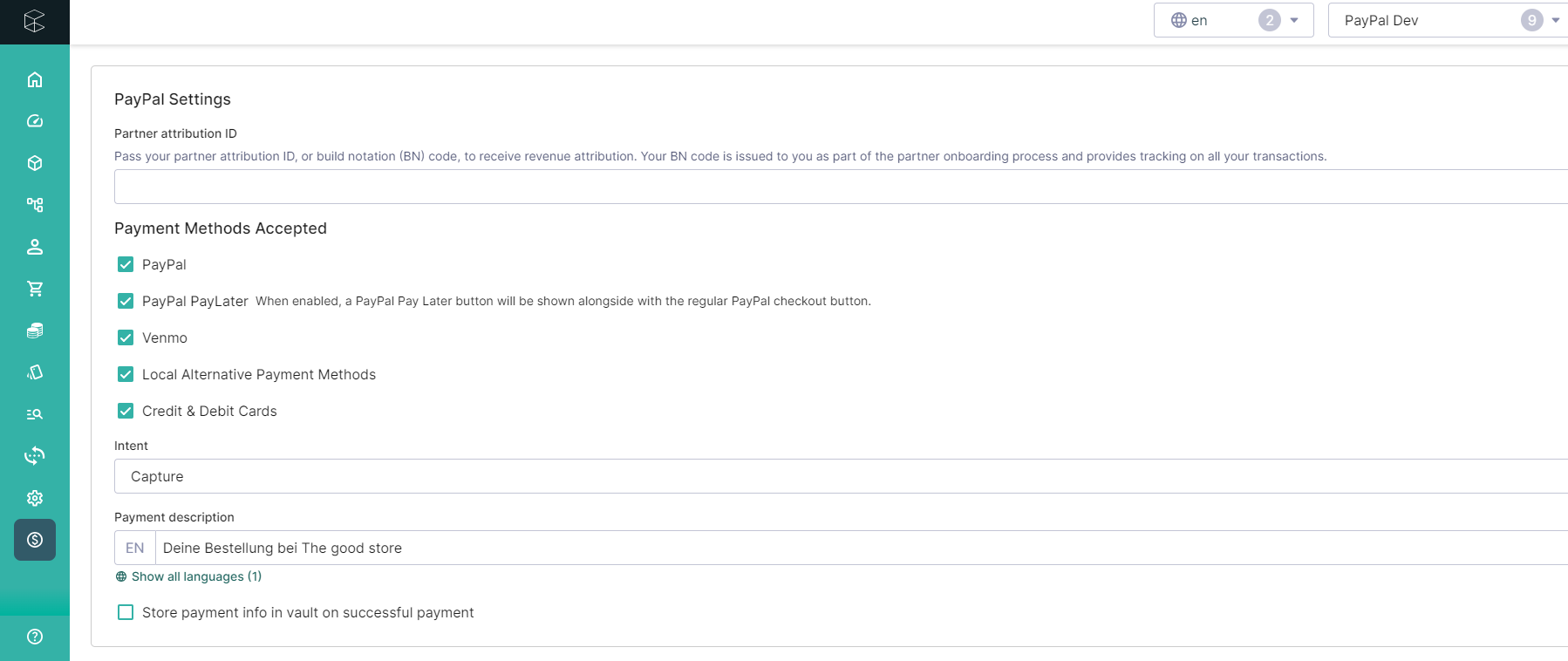

PayPal

PayPal Advanced Credit and Debit Cards

Apple Pay

Google Pay™

Save Payment Methods (PayPal, Cards)

PayPal Pay Later

Venmo (US only)

PayPal Express Checkout

PayPal Pay Upon Invoice (Germany only)

Local payment methods: BLIK, Bancontact, EPS, iDEAL, MyBank, P24

Package Tracking

Features

Capture (partial / full)

Refund

Vaulting

The PayPal Client is developed for the commercetools backend environment and is compatible with the commercetools Frontend as well as other JS Frontends.

To use the PayPal integration in your commercetools environment, you should implement the “PayPal commercetools Connector” and the “PayPal commercetools Client”.

The PayPal commercetools Connector allows you to integrate with PayPal in your commercetools platform.

This Connector includes three different applications, and each application covers a different role in using Braintree with commercetools:

Extension App

commercetools Events App

Admin Application

The Extension App mainly focuses on updates for PayPal's payment and customer types and returns the responses in the custom fields based on each entity. In addition, this application handles after-sale processes and vaulting transactions. Also, it receives and processes different webhooks for each transaction from PayPal.

The commercetools Events App also gets and processes all events which are related to customers and payments.

In the Admin Application, you can change settings related to the PayPal integration in both frontend and backend sides applications.

Finally, “PayPal commercetools Client” is a JavaScript package that you can install from the NPM repository and then use in your frontend, for example in the commercetools Frontend. You will find more information about the integration in the documentation.

*Nielsen Behavioral Panel of USA with 29K SMB monthly average desktop purchase transactions, from 13K consumers between April 2022-March 2023. Nielsen Attitudinal Survey of USA (June 2023) with 2,001 recent purchasers (past 4 weeks) from SMB merchants, including 1,000 PayPal transactions & 1,001 non-PayPal transactions.

** Pay Later is available in US, UK, DE, FR, IT, ES, AU. Product availability subject to local requirements. Merchant and consumer eligibility varies depending on status. Credit checks, fees and other requirements apply and vary depending on product and jurisdiction. See product-specific terms for details.

(1) PayPal Pay Later eligibility and availability is subject to merchant status, sector and integration. Consumer eligibility is subject to status and approval. Product features differ by market. See relevant product terms for more details. PayPal Pay Later cross-border messaging is subject to approval by PayPal.

(2) Globally, Pay Later AOVs are 35%+ higher than standard PayPal AOVs for SMBs. Internal Data Analysis of 68,374 SMB across integrated partners and non integrated partners, November 2022. Data inclusive of PayPal Pay Later product use across 7 markets.

(3) Based on PayPal internal data from 1st Jan 2022 – 31st Dec 2022.

(5) In July 2022, PayPal was recognized as the #1 most downloaded finance and banking app globally. **Apptopia, Top 10 Finance & Banking apps, H1 2022. July 13, 2022.

(6) CR (Consumer Reports), "Buy Now, Pay Later Apps Are Popular, but Are They Safe?" Consumer Reports , May 25, 2023.