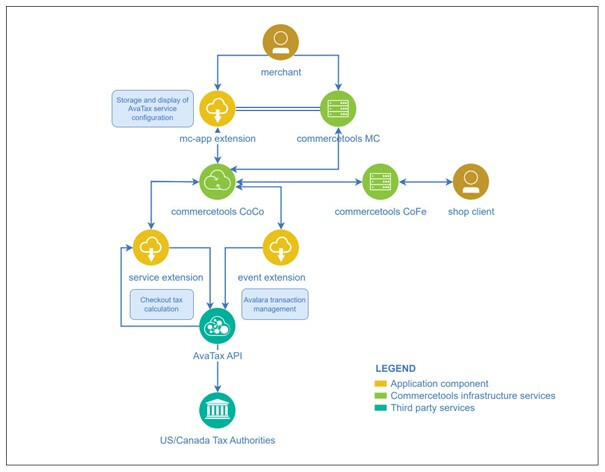

The Avalara connector is an integration facilitating the connection to Avalara’s cloud-based tax calculation solution, which automatically updates sales tax data in your online shop and helps all kinds of businesses to handle complex tax regulations. Avalara AvaTax provides real-time tax calculation using tax rules from more than 13,000 US taxing jurisdictions and content for over 190 countries, ensuring your transaction tax is calculated based on regularly updated tax rules, even for complex product taxability rules and exemptions.

The Avalara for commercetools connector enables an easy handling of exporting products to countries like Canada and the USA. The USA is known for an unclear tax system. So, Avalara makes taxes less taxing for you. The integration connects your commercetools shop with Avalara, allowing commercetools to send transaction data to AvaTax, and AvaTax to send back the tax total. For each transaction to selected countries, the customers of your shop will get a runtime tax-result for their current order. After an order, the data and the tax-result will be transmitted to Avalara and Avalara can report the taxes to the corresponding government.

Automated tax calculations on the checkout page

Automated tax reporting for submitted orders

More than 13,000 US sales and use tax jurisdictions

Tax calculation on discounted items

AvaTax API connection check

Shipping address validation

Origin address check

Country for tax calculation: US/Canada or both

Report refund/cancel tax when cancelling an order

Product and product category codes configuration

Customer exempt (entity use) codes configuration

Shipping tax codes configuration

AvaTax transaction search by shop client number or order number

Connect the AvaTax Account with your commercetools shop.

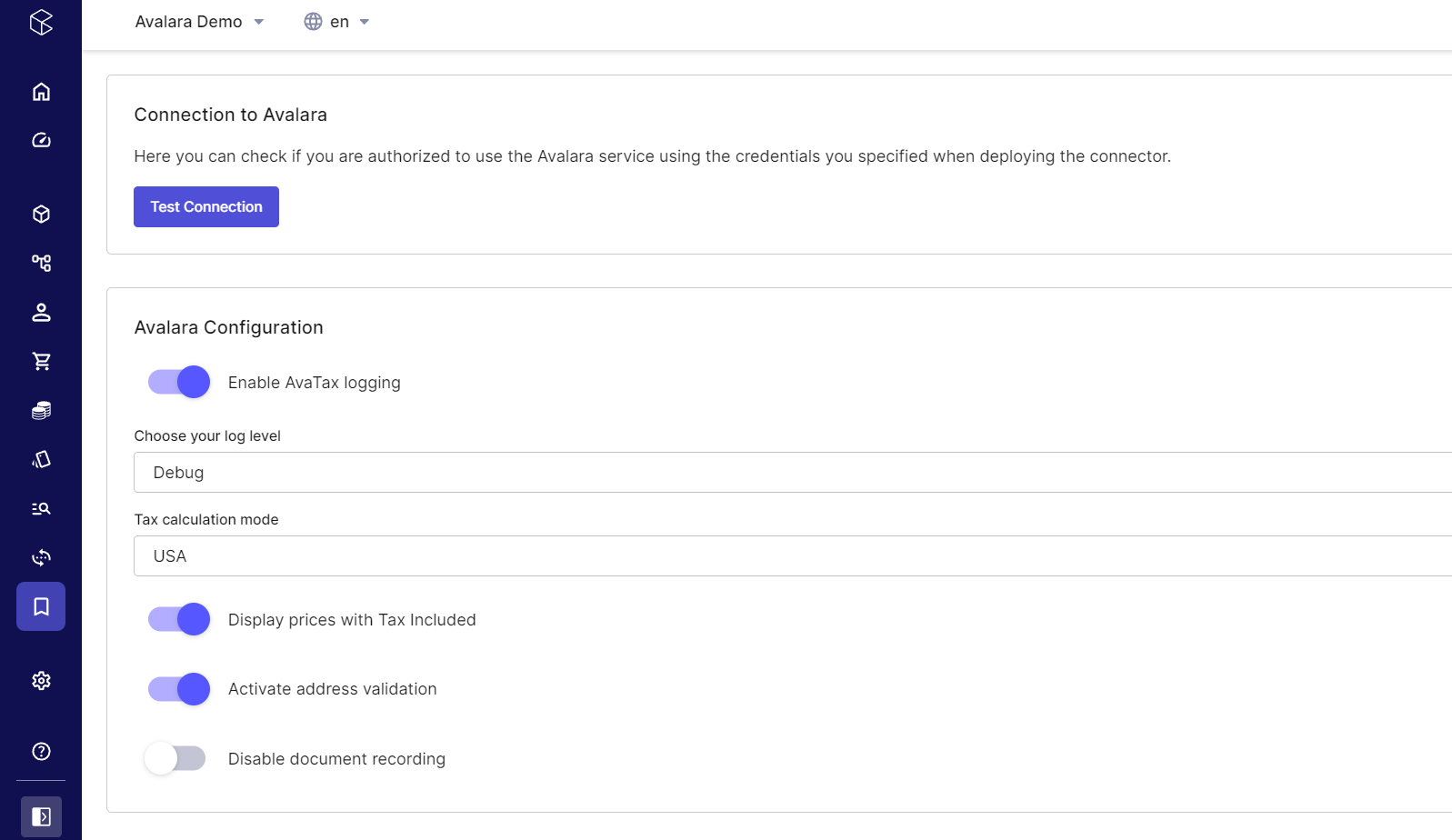

Use your Avalara account number and license key as environment variables in the secured configuration of the connector deployment to connect your shop to your AvaTax Backend. You can also test your existing connection anytime from the Avalara custom application settings page.

Configure the Avalara for commercetools Connector

Enable logging, turn on AvaTax calculation service for selected countries, activate address validation, and so on.

Assign an Avalara tax exempt category to a customer

Enter the customer’s exemption number in the Avalara Entity Use Code field.

Assign an AvaTax System Tax Code to an item

For your product type, create a product attribute (either unique or the same for each variant) with name “avatax-code”, Then for each product of this type you can configure this product attribute and it will be utilized by the connector in its requests to Avalara.

Assign an AvaTax System Tax Code to a Product Category

Enter the AvaTax Code at a chosen category at the AvaTax Code field.

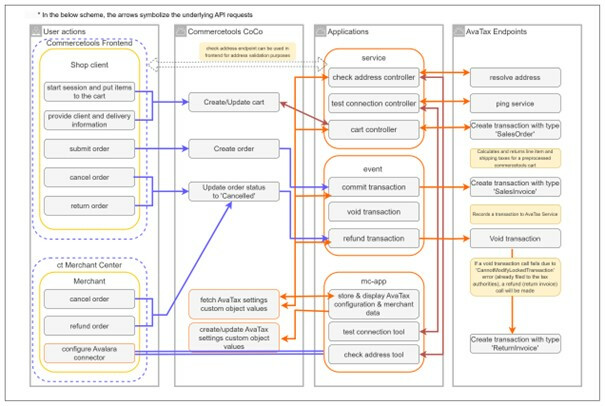

Validate customer’s address

The Avalara commercetools connector provides an endpoint /check-address that can be used for fetching AvaTax Service address validation information directly from your frontend.

Cancelling a transaction

Set easily the transaction status to “Cancelled” at a selected order. This also cancels (or refunds) the transaction in the Avalara backend.